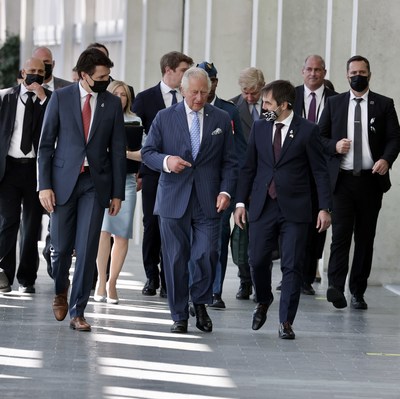

OTTAWA, ON, May 18, 2022 /CNW/ – Today, the Minister of Environment and Climate Change, the Honourable Steven Guilbeault, hosted a roundtable alongside Canada’s Prime Minister, the Right Honourable Justin Trudeau, and His Royal Highness The Prince of Wales to harness the power of sustainable finance in fighting climate change and building strong economies. The roundtable brought together leaders from Canada’s financial and banking sector, Government of Canada institutions, and civil society, as well as other sustainable finance representatives. The event was moderated by Mark Carney, United Nations Special Envoy for Climate Action and Finance and the former Governor of the Bank of England and the Bank of Canada. Discussions identified concrete actions to engage the private sector to build a net-zero economy in Canada and internationally.

The first segment of the roundtable focused on mobilizing private sector capital towards Canada’s clean future. The discussion touched on Canada’s recently released 2030 Emissions Reduction Plan and the policy certainty needed to accelerate investment to achieve emissions objectives. Private sector participants discussed how they are aligning their investments and operations with the net-zero approach and exchanged views on barriers that are hindering further investment.

The second segment of the roundtable centred on how Canada can help mobilize capital to support the net-zero transition internationally. Canada and the Canadian financial sector can play a leadership role in working with developing countries to mobilize private investment to fight climate change, build resilient communities, and create long-term economic growth. With many important international summits on the horizon, including the G7 and the Commonwealth, the Prime Minister and The Prince of Wales acknowledged that it is increasingly important to recognize and emphasize the role that private sector actors must play alongside governments in the fight against the climate crisis.

The roundtable was a critical milestone as Canada continues to harness private sector finances into sustainable investment options, including setting an example globally. Coinciding with the roundtable, the Government of Canada has updated the terms of reference for the Sustainable Finance Action Council to include a focus on the implementation of climate-related financial disclosure and the development of net-zero capital allocation strategies. The Council includes twenty-five of Canada’s leading financial institutions, insurance companies, and pension funds, which have more than $10 trillion in assets combined. The Government of Canada will continue to ensure sustainable financing accelerates progress on climate change. For example, the Government recently issued its inaugural green bonds. Environmentally and socially responsible investors set a Canadian dollar record by snapping up the $5-billion green bond offering with a final order book of over $11 billion.

Private sector capital and expertise are needed to meet our climate objectives and create a climate-resilient economy. Today’s action-oriented discussions will help move Canada towards meeting our emissions objectives while supporting our long-term economic strength.

Associated links

- Sustainable Finance

- Sustainable Finance Action Council

- 2030 Emissions Reduction Plan: Clean Air, Strong Economy

- Terra Carta and Sustainable Markets Initiative

Environment and Climate Change Canada’s Twitter page

Environment and Climate Change Canada’s Facebook page

SOURCE Environment and Climate Change Canada

Back | Next story: GI Hub convenes global experts to advise on a G20 framework to boost investment in sustainable infrastructure