TORONTO, Dec. 28, 2022 /CNW/ – Strategic Minerals Europe Corp. (NEO: SNTA) (FRA: 26K0) (OTCQB: SNTAF) (“Strategic Minerals” or the “Company“) is pleased to announce that it has entered into an option agreement (the “Option Agreement“) with IberAmerican Lithium Inc. (“ILI“) whereby ILI entered into and exercised an option to acquire a 70% interest in the Alberta II investigation permit and the Carlota application for permit (collectively, the “Permits“), all located in the Ribeiro Region, Ourense Province, Galicia, Spain (collectively, the “Lithium Project“).

Pursuant to the Option Agreement, ILI has acquired a 70% equity interest in the Permits in consideration for (i) CDN$1 million paid to the Company at closing and (ii) a non-interest bearing promissory note of ILI to pay the Company an additional CDN$1 million on February 15, 2023. The parties have incorporated IberAmerican Lithium Spain, S.L., a Spanish company, to act as the joint venture vehicle to explore and operate the Lithium Project, and into which the Permits will be transferred subject to local regulatory approval. The Company’s 30% interest and ILI’s 70% interest in the Lithium Project are reflected in their respective shareholdings in IberAmerican Lithium Spain, S.L.

The Company and ILI have also entered into a joint venture agreement and a shareholders’ agreement that will govern the development and eventual operation of the Lithium Project. Under the joint venture agreement, the Company’s 30% interest in the Lithium Project shall be carried at no cost until the completion of a prefeasibility study, after which the Company will have the obligation to fund expenditures pro rata to its interest in the project. ILI will be the operator under the joint venture agreement.

Jaime Perez Branger, CEO of Strategic Minerals stated “We are very pleased to strike this deal with ILI to start the exploration and development of the Lithium Project. With our focus on expanding production at Penouta, we were unable in the near or medium term to commit the necessary cash and resources to commence work at our other properties. This transaction accelerates the timetable for exploring the Lithium Project while allowing Strategic Minerals to retain a significant 30% carried interest in it.”

Information Concerning the Lithium Projects

Strategic Minerals Spain, S.L.U. (“SMS“), the current holder of the Permits and a wholly-owned subsidiary of the Company, had previously engaged Resource Development Associates Inc. to complete a technical report with respect to the Lithium Project dated February 25, 2021 (the “Historical Report“). Readers are cautioned that while the information about the Lithium Project in this press release has been derived from the Historical Report, certain disclosure contains historical estimates (the “Historical Estimates“) as defined in National Instrument 43-101 “Standard of Disclosure for Mineral Projects” (“NI 43-101“). Therefore, readers are advised to refer to notes 1, 2 and 3 where indicated, which set forth the information required by NI 43-101 with respect to the disclosure of historical estimates.

About the Lithium Project

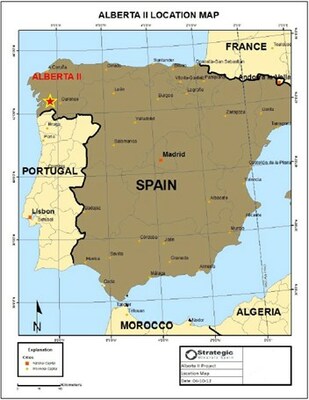

The Lithium Project consists of a 1,015-hectare mineral exploitation contract owned by SMS with granted mineral exploration rights for lithium, tin, tantalum and niobium. The mineral contract is located in the Spanish region of Galicia, within the municipality of Avion, some 440 kilometers northwest of Madrid and 55 kilometers to the southeast of Santiago de Compostela, the capital of Galicia.

The Lithium Project hosts a type of geological formation referred to as albite-spodumene-tantalum-tin, bearing rare-element pegmatites of the lithium‐tantalum‐cesium (“LTC“) pegmatite class. A total of 10 rare element pegmatite dikes have been mapped and identified through surface exposure mapping. The mapped dikes are classified as LTC pegmatite dikes, and the dikes are particularly rich in spodumene, which is understood to be an important lithium bearing mineral. 1,2

The Historical Estimates identify tantalum, tin, lithium, cesium and rubidium assays in each mapped dike. 1,2,3 The project dike swarm is 875 meters in width and 1.3 kilometers in length.

A diamond drilling program had previously been completed in the Lithium Project in 2011 and 2018, consisting of 12 holes totalling 3,074.50 meters drilled. The Historical Estimates reveal that the best intersect of grade and thickness was 10.84m @ 1.24%Li2O. 1,2,3 The addition of two drilling holes in 2018 demonstrated that there are more lithium bearing dikes to be discovered and located on the Lithium Project. To continue exploration at the Lithium Project, an additional drill program would need to be undertaken as well as further soil sampling and more detailed mapping.

On January 28, 2021, SMS requested a 3-year extension of the Alberta II research permit and registered the work plan to be implemented through 2021. SMS has applied for a research permit for the Carlota property.

The following table sets out the Historical Estimates of the inferred mineral resources for the Lithium Project. The data is reported at a cut-off grade of 0.01% Li.

Table 1: Lithium Inferred Resource1,2

| Tonnes(000s) | Sn (ppm) | Sn (KG) | Ta (ppm) | Ta (Kg) | Li2O (%) | Li (Kg) |

| 12,342 | 440 | 5,429,484 | 99 | 1,220,962 | 0.44 | 25,154,609 |

| Notes: | |

| (1) | Source: Wilson, S.E., “Technical Report for the Lithium Project Ribeiro Region, Ourense Province, Galicia, Spain,” prepared for Strategic Minerals Spain S.L. The qualified person for the Existing Technical Report is Scott E. Wilson, CPG, SME (Resource Development Associates, Inc.), and the effective date of the Existing Technical Report is February 25, 2021. Mineral resources are not mineral reserves and do not have demonstrated economic viability. |

| (2) | The reader is cautioned that the Historical Estimates are considered historical in nature and as such are based on prior data and reports prepared by previous property owners. The reader is cautioned not to treat them, or any part of them, as current mineral resources or reserves. The Company has determined these historical resources are reliable, and relevant to be included here in that they demonstrate simply the mineral potential of the Lithium Project. A qualified person has not done sufficient work to classify the Historical Estimates as current resources and Strategic Minerals is not treating the Historical Estimates as current resources. Significant data compilation, re-drilling, re-sampling and data verification will be required by a qualified person before the Historical Estimates can be classified as a current resource. There can be no assurance that any of the historical mineral resources, in whole or in part, will ever become economically viable. In addition, mineral resources are not mineral reserves and do not have demonstrated economic viability. Even if classified as a current resource, there is no certainty as to whether further exploration will result in any inferred mineral resources being upgraded to an indicated or measured mineral resource category. |

| (3) | The mineral resources have been estimated in conformity with generally accepted CIM “Estimation of Mineral Resource and Mineral Reserves Best Practices” guidelines. Vulcan Software was used to construct the geological solids, prepare assay data for geostatistical analysis, construct the block models, estimate metal grades and tabulate mineral resources. The drillhole data for Lithium is maintained by SMS. Resource Development Associates Inc. validated the databases constantly and certified the data to be clean and error free. The drillhole database contains 10 unique drillholes that contain all the assays used in this resource estimation analysis. All 10 holes are angle holes. Angle holes are intended to cross west dipping mineralized structures and identify potential mineable mineralization. Interpretation of the geologic boundaries was done using both drillhole and mapping of the surface outcrop of veins. A total of sixteen (16) pegmatite vein shapes were built. Three (3) veins had both drillhole intercepts and surface mapping. Six (6) veins only had drill intercepts and were built using the average dip for all drill holes. A total of seven (7) veins had surface mapping. Drillhole assays were composited using total vein intercept. The start of each composite is the first pegmatite occurrence and the end of each composite is the second contact with the pegmatite. This compositing was done for each intercept for the full length of the each drillhole. Intervals with no pegmatite were ignored and a new composite was generated at the next pegmatite intercept. The average length of pegmatite vein intersection width is 1 meter. An average grade for each vein was calculated using Microsoft Excel. Each drillhole intercept grade thickness was calculated for each element, for each hole. The grade thickness was grouped into specific veins and an average thickness for each vein was calculated. Each veins average grade thickness was calculated. These calculated grades were assigned to the proper pegmatite vein triangulation. |

Scott E. Wilson, CPG, SME (Resource Development Associates Inc.), a qualified person under NI 43-101 has approved the scientific and technical information contained in this news release.

Related Party Disclosure

Campbell Becher, Jaime Perez Branger and Miguel de la Campa are non-controlling shareholders of ILI and participated in a private placement conducted by ILI to fund this transaction and working capital. Messrs. Becher, Perez Branger and de la Campa are also directors of the Company and as such the entering into of the Option Agreement and the transfer of the 70% interest in the Lithium Project constitute “related party transactions” within the meaning of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101“). For the transaction, the Company has relied on the exemption from the formal valuation requirements contained in Section 5.5(a) of MI 61-101 and has relied on the exemption from the minority shareholder requirements contained in Section 5.7(1)(a) of MI 61-101. Additionally, each of Messrs. Becher, Perez Branger and de la Campa declared a conflict of interest and recused themselves from the Company’s board of directors’ consideration and approval of the transaction.

About Strategic Minerals Europe Corp.

Strategic Minerals’ wholly-owned subsidiary, SMS, produces, identifies, explores, and develops mineral resource properties critical to the green economy, predominantly in Spain. SMS holds permits and a production license for the Penouta Project, and a 30% carried interest in the Lithium Project. SMS is the largest producer of cassiterite concentrate and tantalite in the European Union and has been recognized within the EU as an exemplary company of good practices in the circular economy. The Company is well-positioned as a major producer of sustainable and conflict-free tin, tantalum, and niobium and, through the Joint Venture, is exploring for lithium. Strategic Minerals is a “reporting issuer” under applicable securities legislation in the provinces of British Columbia, Alberta, and Ontario.

Additional information on Strategic Minerals can be found by reviewing its profile on SEDAR at www.sedar.com.

Cautionary Note Regarding Forward-Looking Information:

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release, including without limitation, management’s beliefs regarding expectations relating to the exploration and development of the Lithium Project, and other statements that are not historical facts. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Strategic Minerals to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could cause actual results to differ materially from those anticipated in these forward-looking statements are described under the caption “Risks Factors” in the Company’s Annual Information Form dated March 29, 2022, which is available for view on SEDAR at www.sedar.com. These risks include, but are not limited to, the risks associated with the mining and exploration industry, such as operational risks in development or capital expenditures, the uncertainty of projections relating to production, and any delays or changes in plans with respect to the exploitation of the site. Strategic Minerals disclaims, other than as required by law, any obligation to update any forward-looking statements whether as a result of new information, results, future events, circumstances, or if management’s estimates or opinions should change, or otherwise. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements.

SOURCE Strategic Minerals Europe Corp.

Back | Next story: Trip.com reflects on its part played in a year of recovery