TORONTO, Aug. 10, 2023 /CNW/ – Consistent with its dual-market strategy to supply both the global glass-ceramics market and North American EV battery manufacturing, Avalon Advanced Materials Inc. (TSX: AVL) and (OTCQB: AVLNF) (“Avalon” or the “Company”) is pleased to announce an updated Mineral Resource Estimate (“MRE”) for the Avalon-Sibelco joint venture lithium deposit at Separation Rapids. This updated MRE, compliant with NI 43-101, reports 10.08 million tonnes (Mt) averaging 1.35% of Measured and Indicated Lithium Oxide (“Li2O”), a 20% increase compared to previous results.Separation Rapids MRE Highlights:

- Open Pit with a Measured and Indicated category of 9.39 Mt averaging 1.34% Li2O with the start of an underground resource of 0.68 Mt averaging 1.43% Li2O

- 10.08 Mt averaging 1.35% Li2O in Measured and Indicated, a 20% increase in size as compared to 2018 results

- 2.81 Mt averaging 1.38% Li2O in the Inferred category, a 57% increase in size as compared to 2018 results

- 136,000 tonnes of Li2O in Measured and Indicated, a 15% increase in size as compared to 2018 results

- 39,000 tonnes Li2O in the Inferred category, a 60% increase in size as compared to 2018 results

- Exploration Potential of an additional 3 Mt to 6 Mt of resource, grading between 1.0 and 1.4% Li2O which could relate to an increase in Li2O by 30,000 to 80,000 tonnes.

| Note: This potential additional quantity and grade are conceptual in nature. There has been insufficient exploration to define this additional mineral resource and it is uncertain if further exploration will result in the target being delineated as a mineral resource. The basis for this exploration potential has been determined using the same methodology as for the MRE. |

Located near Kenora, ON, the Separation Rapids deposit is owned by the recently announced joint venture between Avalon and SCR-Sibelco NV (“Sibelco”), an Antwerp-based company and leader in the global glass-ceramics and materials solutions business, with projects in over 30 countries.

“This updated estimate reveals the quality and quantity of the resource at Separation Rapids, and underscores the rationale for the strategic partnership between Avalon and Sibelco. It confirms that the deposit can deliver sufficient volumes of commercial-grade feedstock suitable for both the glass-ceramics and lithium battery markets,” said Scott Monteith, Avalon CEO. “This data gives Avalon and Sibelco the confidence to pursue the next phase of development at Separation Rapids, finalizing a definitive feasibility study and moving towards production.” Mineral Resource Estimate (“MRE”)

The MRE for the Separation Rapids lithium deposit (Table 1 below) was conducted by SLR Consulting (Canada) Ltd. (“SLR”), an independent global mining advisory and consulting firm, using available drill hole data as of June 16, 2023. The MRE was prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). This updated MRE replaces the Company’s previous MRE dated May 23, 2018. The updated MRE is based on 98 surface diamond drill holes for a total of 17,444m of drilling. This includes 13 new surface diamond drill holes totaling 4,128.3m1 drilled since the 2018 resource estimate.

The new resource estimate will be incorporated into a definitive feasibility study of Separation Rapids, to be completed by early to mid-2024, with the intention of commencing on-site operations in 2026.

Table 1: Mineral Resource Estimate – Separation Rapids, August 7, 2023

| Description | Classification | Tonnage (Mt) | Li2O (%) |

| Open Pit | Measured | 4.28 | 1.33 |

| Indicated | 5.12 | 1.35 | |

| Measured + Indicated | 9.39 | 1.34 | |

| Inferred | 1.60 | 1.34 | |

| Underground | Measured | – | – |

| Indicated | 0.68 | 1.43 | |

| Measured + Indicated | 0.68 | 1.43 | |

| Inferred | 1.21 | 1.42 | |

| Total | Measured | 4.28 | 1.33 |

| Indicated | 5.80 | 1.36 | |

| Measured + Indicated | 10.08 | 1.35 | |

| Inferred | 2.81 | 1.38 |

| Notes: | |

| 1. | CIM (2014) definitions were followed for Mineral Resources. |

| 2. | Mineral Resources are reported using a petalite concentrate price assumption of US $1,300/t with an exchange rate of US$1 = C$1.30. |

| 3. | Open pit Mineral Resources are reported at a 0.29 % Li2O cut-off grade (COG) in a Whittle resource shell. The Whittle resource shell and open pit COG grade are based on a mining cost of C$5.50/t, general and administration cost of C$3.50/t, a processing cost of C$55.00/t, and a recovery of 50%. |

| 4. | Underground Mineral Resources are reported within Deswik resource panels which were generated using a breakeven 0.9 % Li2O COG. The underground breakeven COG grade is based on a mining cost of C$120/t, general and administration cost of C$3.50/t a processing cost of C$55.00/t, a recovery of 50%, and an exchange rate of US$1 = C$1.30. The Deswik resource panels are 5 m by 5 m by 3 m wide. |

| 5. | Mineral resources are reported based on a minimum thickness of approximately 3 m. |

| 6. | Average bulk densities were assigned to the blocks and range between 2.61 t/m3 and 2.66 t/m3 for the lithium pegmatite. |

| 7. | Numbers may not add due to rounding. |

| 8. | Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

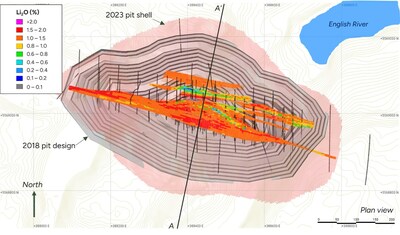

Figure 1: 2023 Resource Pit Shell, 2018 PEA Pit Design, and 2023 Block Grades

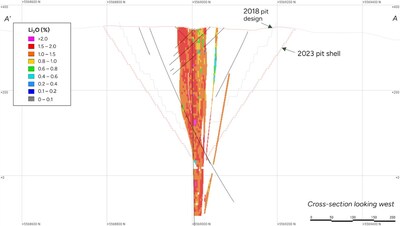

The 2023 resource pit shell extends horizontally and vertically for approximately 50m to 100m further than the 2018 pit design (Figures 1 and 2).

Figure 2: Cross Section Showing 2023 Resource Pit Shell, 2018 PEA Pit Design, and 2023

Block Grades

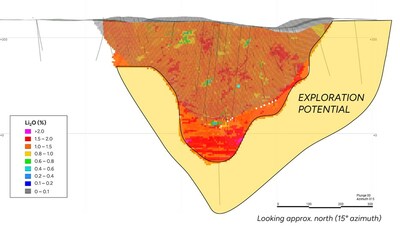

Figure 3: Longitudinal Section Showing 2023 Resource Pit Shell, Underground Resources,

and Exploration Potential

Based on the current analysis, SLR estimates that there exists an additional 3 Mt to 6 Mt of exploration potential at a grade of approximately 1.0% to 1.4% Li2O located below the open pit and underground resources (Figure 3).

| Note: This potential additional quantity and grade are conceptual in nature. There has been insufficient exploration to define this additional mineral resource and it is uncertain if further exploration will result in the target being delineated as a mineral resource. The basis for this exploration potential has been determined using the same methodology as for the MRE. |

“SLR’s analysis shows a substantive increase of the size of the deposit in overall tonnage and metal quantity. As well, the exploration potential in the range of 3 Mt to 6 Mt will allow Avalon to be laser focused on additional drilling to bring this into at least an indicated category,” Rickardo Welyhorsky, Chief Operating Officer at Avalon, said. “The high definition of the resource and the exploration potential supports transitioning to a Definitive Feasibility Study while further drilling out and increasing our resource.”Mineral Resource Estimation Methodology

An updated MRE was created by SLR using Seequent’s Leapfrog Geo and Edge software. Wireframes were created using logged lithology. Initially the pegmatite outlines were modelled, followed by the creation of sub-domains between the Petalite and Lepidolite-Petalite mineralogical types. Internal waste horizons of amphibolite have been modelled where continuity exists. Raw assays were capped and then composited to two metre lengths, broken at domain boundaries. Li2O, Cs2O, Rb2O and Ta2O5 were interpolated using Ordinary Kriging (OK) into a block model comprising of 5 x 3 x 5 (x, y, z) metre blocks, with sub-blocking down to one metre. Search ellipses were oriented using dynamic anisotropy. Nearest Neighbour (NN) estimates were run for validation purposes. Density was assigned using mean values for each lithological domain.

Blocks were classified following CIM (2014) definitions using a combination of drillhole spacing and grade continuity. Drill hole spacings of up to approximately 25 m for Measured, 50 m for Indicated, and 100 m for Inferred have been used to support the classification. Mineral Resources have been constrained with an optimized pit shell, using a cut-off grade of 0.29 % Li2O, for the open pit material and resource panels, that were generated at a cut-off grade of 0.9 % Li2O, for the underground material.Qualified Person

The MRE for Separation Rapids was prepared by Volker Moeller, Ph.D., P.Geo., SLR Senior Resource Geologist, under the supervision of Luke Evans, M.Sc., P.Eng., SLR Principal Resource Geologist. Mr. Evans is an “Independent Qualified Person” as defined by NI 43-101. The Qualified Person is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the MRE.

About Avalon Advanced Materials Inc.

Avalon Advanced Materials Inc. is a Canadian mineral development company focused on vertically integrating the Ontario lithium supply chain. The Company, through its joint venture with Sibelco NV, is currently developing its Separation Rapids lithium deposit near Kenora, ON, while continuing to advance other mineral projects in its portfolio, including the joint venture owned Lilypad Spodumene-Cesium-Tantalum Project located near Fort Hope, ON.

In addition to these upstream activities, Avalon is executing on its key strategic objective of developing Ontario’s first midstream lithium hydroxide processing facility in Thunder Bay, ON, a vital link bridging the lithium production in the north with downstream EV battery manufacturing markets in the south. Social responsibility and environmental stewardship are corporate cornerstones. Avalon is listed on the TSX.

About SCR-Sibelco NV

Headquartered in Antwerp, Belgium, SCR-Sibelco NV is a global leader in material solutions. Sibelco mines, processes and sells specialty industrial minerals – particularly silica, clays, feldspathics and olivine – and is a leader in glass recycling. Sibelco’s solutions serve a diverse range of industries including semi-conductors, solar photovoltaic, glass, ceramics, construction, coatings, polymers and water purification. The Sibelco Group has production facilities in more than 30 countries and a team of more than 5,000 people worldwide.

For investor relations and media inquiries, please e-mail the Company at ir@AvalonAM.com, or phone Zeeshan Syed, President, at (647) 300-4706.

| 1 | In Avalon’s public announcement of May 4, 2023, it was reported that total new drilling was 4,179m. The actual figure was 4,128.3m. |

Forward-Looking Statements

Statements included in this news release, including any with respect to the Company’s future financial or operating performance and other statements that express management’s expectations or estimates of future performance, including statements in respect of the completion of the joint venture, the use of proceeds of the Private Placement, prospects and/or development of the Company’s projects, other than statements of historical fact, constitute forward-looking information or forward-looking statements within the meaning of applicable securities laws (collectively referred to herein as “forward-looking statements”) and such forward-looking statements are based on expectations, estimates and projections as of the date of this news release. Forward-looking statements in this news release include, but are not limited to, statements with respect to: the Company’s strategic review of certain of its assets; the development of the Company’s material lithium projects, the Company’s plans with respect to the exploration and development of its properties, costs of production, expected capital expenditures, operations outlook, expected benefits from the joint venture, the expected receipt of permits; permitting timelines, the future price of commodities; foreign exchange rates and currency fluctuations; requirements for additional capital; the Company’s capital allocation; the estimation of mineral reserves and mineral resources; the realization of mineral reserve and mineral resource estimates, and government regulation of mining operations. Forward-looking statements are provided for the purpose of providing information about management’s current expectations and plans relating to the future. Forward-looking statements are generally identifiable by the use of words such as “may”, “will”, “should”, “continue”, “expect”, “budget”, “forecast”, “anticipate”, “estimate”, “believe”, “intend”, “plan”, “schedule”, “guidance”, “outlook”, “potential”, “seek”, “targets”, “suspended”, “strategy”, or “project” or the negative of these words or other variations on these words or comparable terminology.

The Company cautions the reader that forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, financial, operational and other risks, uncertainties, contingencies and other factors, including those described below, which could cause actual results, performance or achievements of the Company to be materially different from results, performance or achievements expressed or implied by such forward-looking statements and, as such, undue reliance must not be placed on them. Forward-looking statements are also based on numerous material factors and assumptions, including as described in this news release, including with respect to: the completion of the joint venture, use of proceeds from the Private Placement, the Company’s present and future business strategies, operations performance within expected ranges, local and global economic conditions and the economic environment in which the Company will operate in the future, legal and political developments in the jurisdictions in which the Company operates, the price of lithium and other key commodities; projected mineral grades; international exchanges rates; anticipated capital and operating costs; the availability and timing of required governmental and other approvals for the Company’s projects.

Risks, uncertainties, contingencies and other factors that could cause actual results, performance or achievements of the Company to be materially different from results, performance or achievements expressed or implied by such forward-looking statements include, without limitation: the Company’s business strategies and its ability to execute thereon, including the ongoing strategic review of certain of the Company’s assets; political and legal risks; risks associate with the estimation of mineral reserves and mineral resources; the ongoing impacts of the Ukraine war, the availability of labour and contractors; the volatility of the Company’s securities; management of certain of the Company’s assets by other companies or joint venture partners; the lack of availability of insurance covering all of the risks associated with a mining company’s operations; business risks, including pandemics, adverse environmental conditions and hazards; unexpected geological conditions; potential shareholder dilution; increasing competition in the mining sector; changes in the global prices for lithium and certain other commodities; consolidation in the lithium mining industry; legal, litigation, legislative, political or economic risks; government actions taken in response to potential future public health emergencies and pandemics, including new variants of COVID-19, and any worsening thereof; changes in taxes, including mining tax regimes; the failure to obtain in a timely manner from authorities key permits, authorizations or approvals necessary for exploration, development or operations; the availability of capital; the level of liquidity and capital resources; access to capital markets and financing; the Company’s level of indebtedness; the Company’s ability to satisfy covenants under its outstanding debt instruments; changes in interest rates; the Company’s choices in capital allocation; risks related to third-party contractors; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; the fact that reserves and resources, expected metallurgical recoveries, capital and operating costs are estimates which may require revision; failure to meet operational targets; equipment malfunctions; laws and regulations governing the protection of the environment; physical and regulatory risks related to climate change; the potential direct or indirect operational impacts resulting from external factors, including infectious diseases, public health emergencies or pandemics, such as COVID-19, unpredictable weather patterns and challenging weather conditions; attraction and retention of key employees and other qualified personnel; availability and increasing costs associated with mining inputs and labour; the availability of qualified contractors and the ability of contractors to timely complete projects on acceptable terms; the relationship with the communities surrounding the Company’s operations and projects; indigenous rights or claims; and the inherent risks involved in the exploration, development and mining industry generally. Please see the Company’s current annual information form available on www.sedar.com or for a comprehensive discussion of the risks faced by the Company and which may cause actual results, performance or achievements of the Company to be materially different from results, performance or achievements expressed or implied by forward-looking statements.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as required by applicable law.

View original content to download multimedia:https://www.prnewswire.com/news-releases/avalon-announces-a-substantive-20-increase-in-deposit-size-at-its-flagship-separation-rapids-joint-venture-lithium-project-301897792.html

SOURCE Avalon Advanced Materials Inc.

Back | Next story: Fiera Capital Reports Second Quarter 2023 Results