- Acquired in 2020 for $10 million by a consortium of Chinese mining companies

- Exited 76% stake with $31 million profit in an all-cash transaction

NEW YORK, Feb. 16, 2023 /CNW/ — Hedonova, a Paris-based hedge fund, has exited its 76% stake in an Indonesian nickel miner Mineralindo Morowali to a consortium of Chinese mining companies called Indo-pacific Net-zero Battery-materials Consortium (INBC) for $31 million in an all-cash transaction. The stake was acquired for $10 million in February 2020.

Hedonova will also exit its complementary investments in the region, including $4 million in leased equipment, a smelter, a current inventory of 300 tonnes of Nickel ore, and a 30 megawatt/hour solar power plant that supplies electricity to the mine.

The mine is the only one in the region which is carbon neutral and issues carbon credits, the rights to which will be retained by Hedonova for the next three years.

Indonesia holds the world’s largest nickel reserve, a key component in the oncoming electric vehicles revolution. This has led to Chinese mining companies investing more than $14 billion in the last few years. As part of the sale agreement, there will be no job cuts or changes in worker conditions. Alexander Cavendish, CEO Hedonova, says, “Our topmost priority before this sale was to ensure that working conditions are upheld to the same standards as it was when we were the owners. The Morowali mine is currently ISO/TC 82 and ISO/TC 82/SC 8 certified, which means most systems are automated and do not require humans to work in harsh conditions.

There is general bullishness around long-term nickel prices, but we decided to exit given environmental concerns in the Morowali region. Increased competition and lowering ESG conditions led to us exiting the mine. Our Governance committee, which oversees the sustainability, diversity, and inclusivity aspects of our portfolio voted unanimously on the exit, and I wholeheartedly support the decision. Without purpose, there is no point of profits.”

Hedonova is an active investor in Indonesia, with more than $50 million invested in the country’s energy, healthcare & startup sector and has earmarked the proceeds of this sale into other investments in the country.

Cavendish added, “We’ve explored more lucrative opportunities in the healthcare and energy storage and carbon removal space into which we will be investing in 2023.”

He further adds, “Although nickel is an essential component of lithium-ion batteries, which are used in electric vehicles, the development of new battery technologies that use fewer amounts of nickel or no nickel at all could reduce demand. In addition, an economic slowdown or recession could also reduce demand for nickel as it is primarily used in industrial applications. Furthermore, the supply of nickel could also increase as new mines are developed or existing mines increase production, which could lead to an oversupply and lower prices. Finally, increasing trade tensions and geopolitical risks could also negatively affect demand for nickel and cause prices to decline.”

Contact: media@hedonova.io

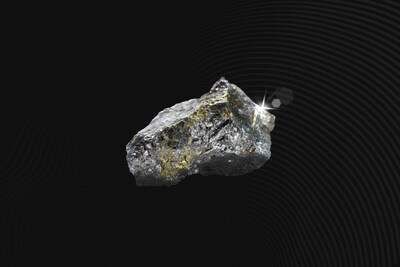

Photo: https://mma.prnewswire.com/media/2004009/Nickel_Metal_ore.jpg

View original content to download multimedia:https://www.prnewswire.com/news-releases/hedonova-exits-its-stake-in-indonesian-nickel-miner-mineralindo-morowali-with-310-gains-301748768.html

SOURCE Hedonova.io

Back | Next story: New Partnership between ASC and Sunco Communication & Installation